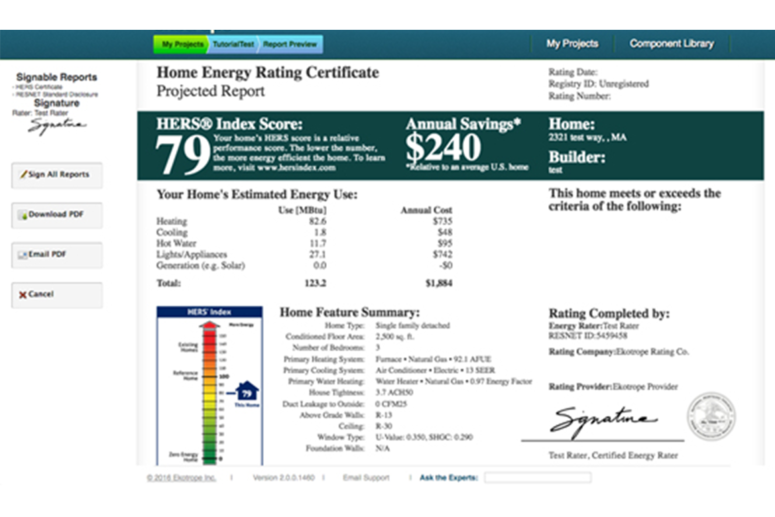

HERS Verification Report

Your custom HERS Verification Report includes a virtual model of your home and identifies each vulnerability in your home’s HVAC system and its thermal envelope, which includes insulation, windows, and doors. This custom calculation of energy loss determines the cost and excess output of energy on your home’s heating and cooling systems. Our expert team is then able to restore or replace issues to reduce energy loss and improve your home’s overall energy rating.

Individuals qualified to provide air leakage testing include energy auditors, energy raters, Class A or B air-conditioning contractors and mechanical contractors, plus approved third parties.

Understanding the Florida Building Code Guidelines

Since 2017, the state of Florida has required energy testing as part of the 2014 Florida Building Code. The requirements are listed in Section R402.4.1.2, a revisional code added to the 5th edition of the 2014 FBCEC (Florida Building Code, Energy Conservation). You can access this supplemental code here: https://www.floridabuilding.org/fbc/thecode/2017_Code_Development/Glitch_2016/2016_Supplement_to_the_5th_Edition_2014_FBC.htm

Per Florida code, a home cannot change out its conditioned air more than 7x per hour in order to meet compliance itemized within the guidelines. As a comparison, an efficient home should change its air out about 3 times per hour. A Blower Door Test is capable of determining how many air changes happen per hour in your home using powerful wind-driven technology and by gauging the pressure versus the outside environment. When a test reveals a high level of air exchange, leaks and vulnerabilities in the homes HVAC System and Thermal Envelope must be fixed.

Even if your home or commercial space is not new construction, getting a comprehensive HERS Report can identify what changes you can make to lower your energy cost and consumption:

- Save money in utility costs

- Improve your home’s energy rating (great for resale value)

- Reduce your impact on the environment

- Qualify for valuable tax credits