45L

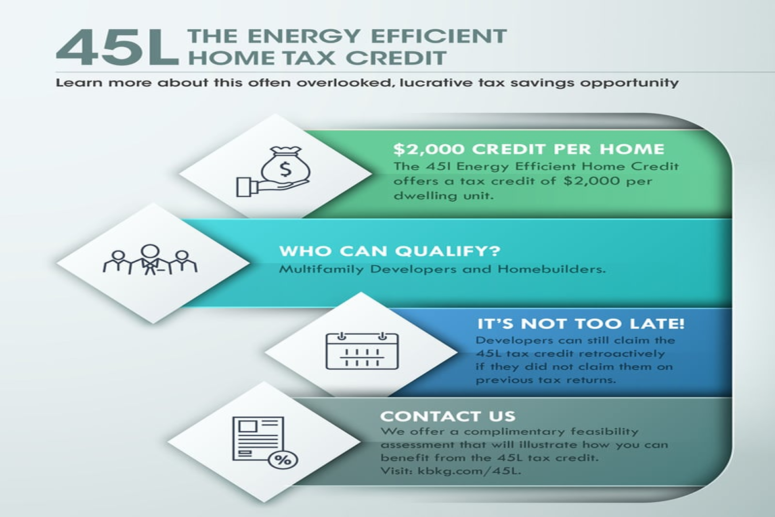

The 45L tax credit allows a savings of up to $2,000 for dwellings that meet certain energy requirements. The credit is available for new construction or unit rehabilitation on or after August 8, 2005, including low-rise multi-family properties of 3 floors or less, or single-family residence homes.

The credit is available during the year the unit or home is sold, and is given to the eligible contractor. For single-family homeowners, they may take advantage of the tax credit if they hire a third-party contractor and have basis in the home during its construction.

To claim the energy credit, the eligible contractor must obtain a certification from an independent certifier, like Blue Sky Energy. An eligible certifier must be accredited or authorized by the Residential Energy Services Network (RESNET). Appropriate computer modeling and on-site testing and evaluations determine if the dwelling meets the standard outlined in the tax code to receive the tax credit.

Builders and residents have to act in a timely manner to receive this one-time tax credit, as the eligibility window is only available for up to 3 years after the dwelling is released or sold.